Katsina’s Revenue Rises but Debt, FAAC Dependence Deepen — BudgIT

Katsina’s Revenue Rises but Debt, FAAC Dependence Deepen — BudgIT

Zaharaddeen Ishaq Abubakar | Katsina Times

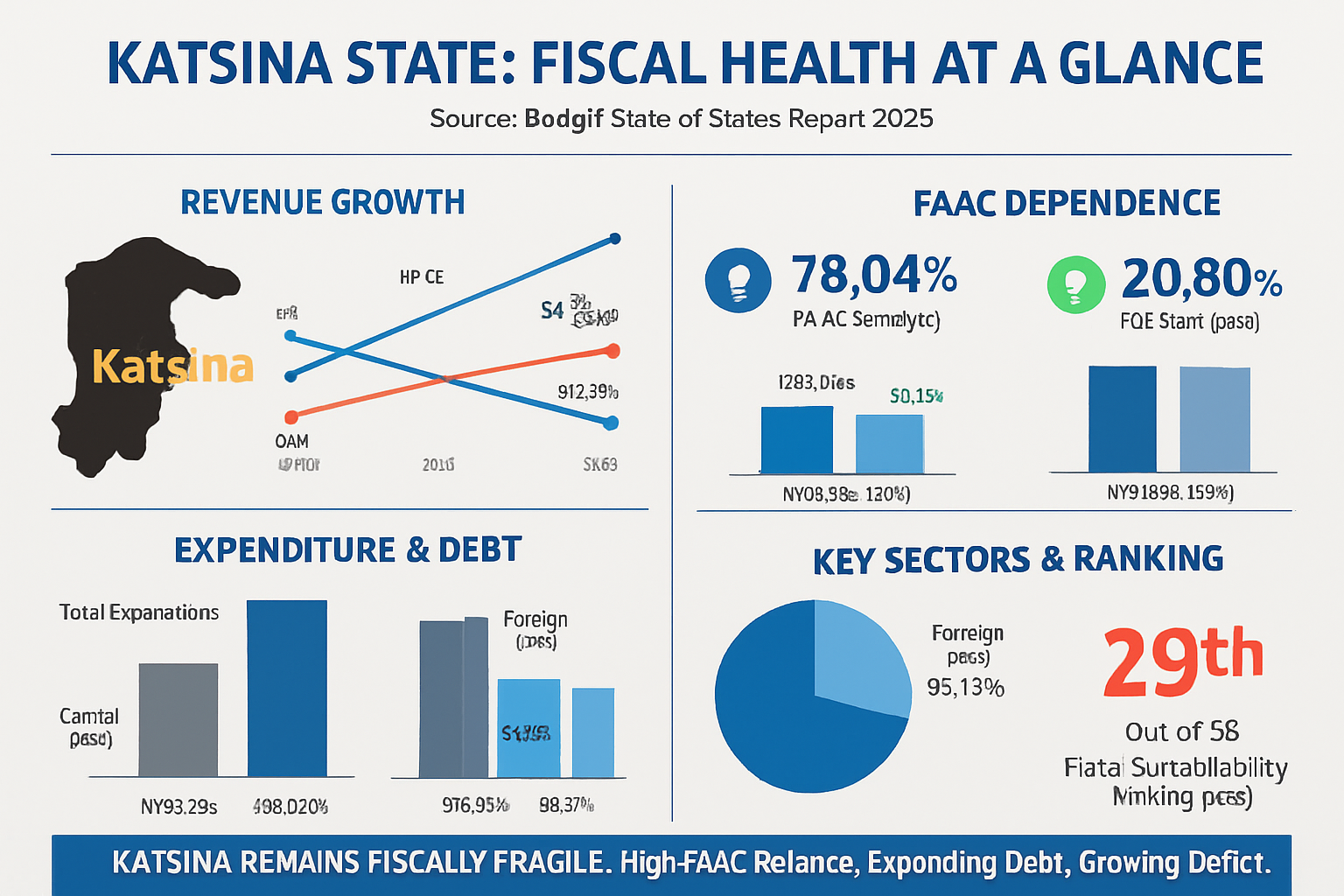

Katsina State recorded strong growth in revenue and capital spending in 2024, but remains heavily dependent on federal allocations while its debt burden continues to rise, according to the latest State of States Report 2025 by BudgIT.

The report shows that although the state made notable gains in Internally Generated Revenue (IGR), its fiscal profile is still weak, with widening deficits, increasing liabilities and a sustained dependence on the Federation Account Allocation Committee (FAAC).

IGR Grows, but FAAC Still Dominates

Katsina’s IGR increased by 51.70 percent, rising from N20.84 billion in 2023 to N31.61 billion in 2024. Tax revenue was the major driver, surging by 164.09 percent, while non-tax revenue declined sharply by 43.96 percent due to the absence of reimbursements and miscellaneous income.

Despite this improvement, FAAC remains the state’s lifeline. Katsina received N256.81 billion in federal allocations in 2024 — a 144.23 percent jump from 2023 — accounting for 89.04 percent of its recurrent revenue. IGR contributed only 10.96 percent.

BudgIT notes that although the state’s IGR grew by 445.87 percent between 2015 and 2024, Katsina has yet to achieve meaningful revenue independence.

Expenditure Jumps to N442bn; Fiscal Deficit Widens

Katsina’s total expenditure rose from N175.82 billion in 2023 to N442.24 billion in 2024, representing a 151.53 percent increase. Capital expenditure alone surged by over 326 percent, reaching N238.46 billion — 56.21 percent of total spending.

Operating expenditure stood at N185.78 billion, covering personnel costs of N52.20 billion, overheads of N37.54 billion, and other expenses totaling N96.05 billion.

Despite growing revenues, the state posted a fiscal deficit of N122.13 billion in 2024, highlighting spending pressures and reliance on fresh borrowing to fund capital projects.

Debt Stock Hits N179.92bn

Katsina’s debt profile reached N179.92 billion by December 2024, up from N144.56 billion in 2023 — a 24.46 percent increase.

Key debt indicators include:

-

Domestic debt: N25.68 billion

-

Foreign debt: $100.46 million (85.73 percent of total debt)

-

Debt-to-revenue ratio: 56.21 percent (within 200 percent benchmark)

-

Debt-service-to-revenue ratio: 5.62 percent (well below 40 percent threshold)

However, total debt has grown by 608.55 percent over the past decade, with BudgIT warning that rising borrowing could expose the state to long-term fiscal strain.

Outstanding liabilities stood at N2.22 billion in 2024, including contractor arrears of N2.08 billion and pension arrears of N136.85 million.

Health and Education Spending Improve

Spending on health increased from N10.61 billion in 2023 to N28.29 billion in 2024, with performance rising from 36.35 percent to 76 percent. Per capita health spending also improved to N2,841.

Education received N70.56 billion, up from N21.61 billion in 2023, achieving a performance rate of 101.64 percent. Per capita education spending rose to N7,087.

BudgIT, however, notes that spending levels remain modest when compared to population needs.

Fiscal Sustainability Ranking Declines

Katsina ranked 29th out of 35 states in overall fiscal sustainability in 2025, a sharp fall from 5th position in 2015. The report attributes this decline to weak revenue diversification, increasing expenditure, and a rising debt profile.

Conclusion

BudgIT concludes that Katsina’s fiscal outlook remains fragile. While revenue and capital spending have grown strongly, the state remains structurally dependent on FAAC and continues to accumulate debt at a rapid pace.

The organisation recommends that Katsina:

-

broaden its tax base

-

strengthen IGR collection systems through technology

-

reduce borrowing

-

adopt more sustainable long-term fiscal planning

Without these reforms, the state risks deeper fiscal distress despite the short-term gains recorded in 2024.